3 Step AI Automation- Purchase Order to Workday Financials

$0.00

| Workflow Name: |

Automate Purchase Order to Workday Financials |

|---|---|

| Purpose: |

Automate end-to-end PO flow for accuracy and faster fulfillment. |

| Benefit: |

Cuts manual work, speeds order cycles,improves data accuracy |

| Who Uses It: |

Procurement Managers, Finance Teams, ERP Admins, Supply Chain Analysts. |

| System Type: |

ERP |

| On-Premise Supported: |

Yes — IPSec tunnel for secure internal data transfer |

| Supported Protocols: |

REST, HTTPS, SOAP, SFTP. |

| Industry: |

Retail |

| Outcome: |

90% faster; 100% accuracy |

Table of Contents

Description

| Problem Before: |

Manual PO entry caused data errors, duplicate records, and delayed approvals. |

|---|---|

| Solution Overview: |

Automated real-time synchronization of purchase orders from external procurement systems to Workday Financials |

| Key Features: |

Real-time PO sync, validation, error handling, audit trails, and dashboards for visibility. |

| Business Impact: |

Cuts PO cycle time by 70%, improves accuracy by 95%, and eliminates most manual entry. |

| Productivity Gain: |

Teams process 3× more POs, freeing time for analysis and planning. |

| Cost Savings: |

Saves $50K–$100K annually; achieves ROI within 3–4 months. |

| Security & Compliance: |

SOC 2, ISO 27001, and GDPR compliant for secure data handling. |

Automate Purchase Order to Workday Financials

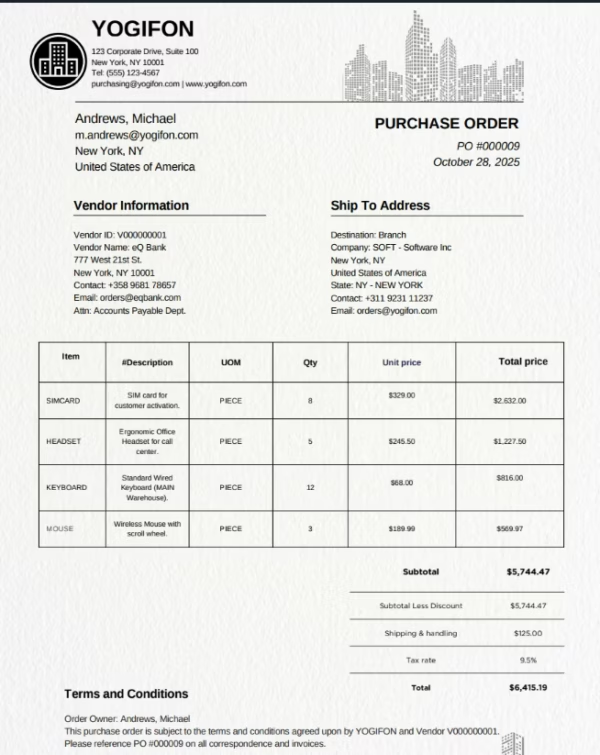

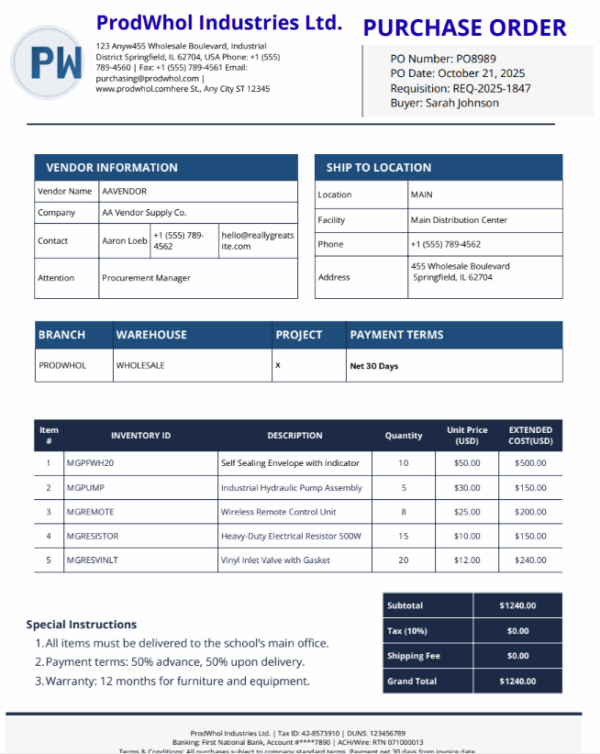

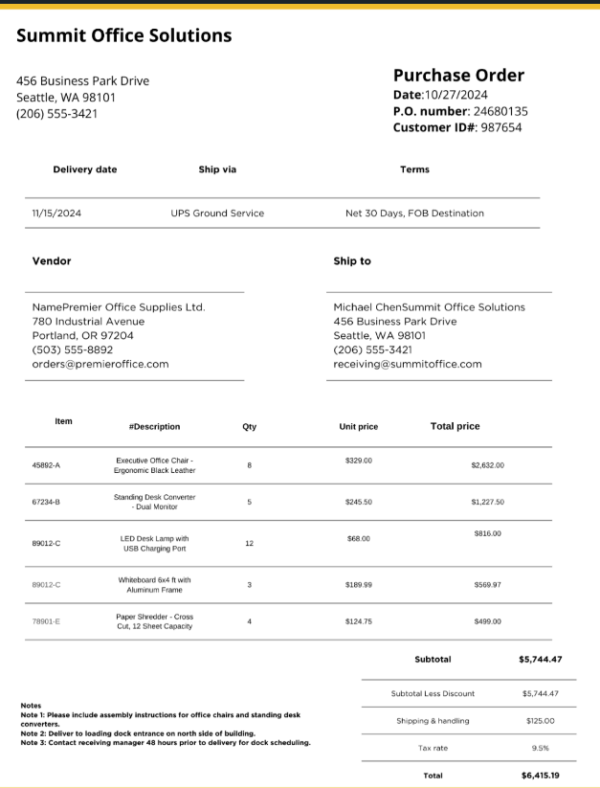

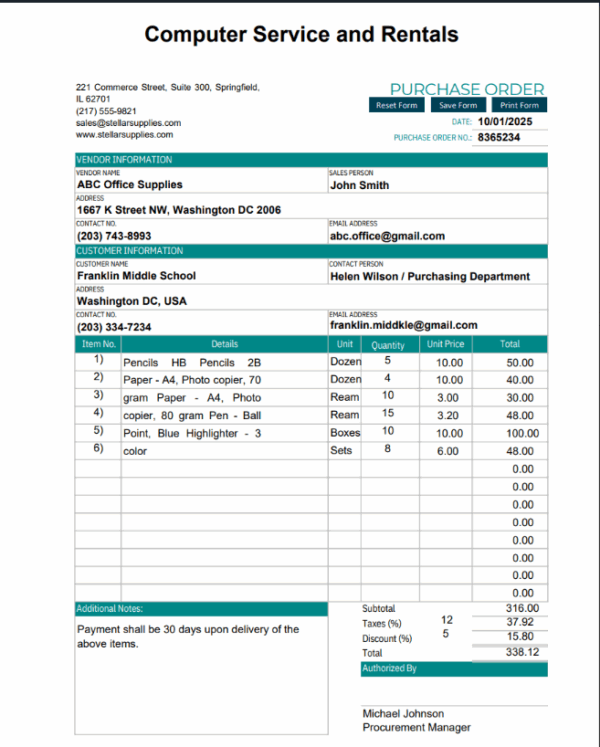

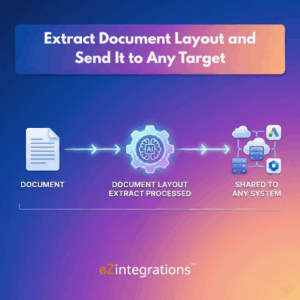

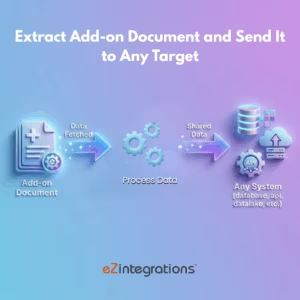

Streamline the entire Purchase Order to Workday Financials process by automating data extraction, validation, and synchronization—directly from PDFs or image-based documents. This no-code workflow leverages AI to read, interpret, and map PO to Workday Financials schema with high accuracy.

Intelligent Document Understanding

Using AI-powered document recognition, the system identifies key fields such as PO Number, Vendor, Material Codes, Quantity, and Amount from PDF, JPEG, or scanned purchase orders. It automatically validates and standardizes the data before pushing Purchase Order for seamless procurement processing.

Watch Demo

| Video Title: |

Automate Unstructured Purchase Orders in Any Format (PDF/PNG/Docx) into Workday Financials| eZintegrations™ |

|---|---|

| Duration: |

03:20 |

| Video Description: |

In this demo, we showcase how eZintegrations™ AI automates the entire Purchase Order processing workflow from reading unstructured PDF or PNG files in various formats… |

Outcome & Benefits

| Accuracy: |

Ensures 99% data accuracy by eliminating manual entry errors and automating order validation. |

|---|

Outcome & Benefits

| Time Savings: |

Reduces purchase order processing time by up to 70% through automated data flow between procurement systems and Workday Financials |

|---|---|

| Cost Reduction: |

Minimizes manual effort and data re-entry costs, resulting in 40?50% operational cost savings annually. |

| Accuracy: |

Ensures 99% data accuracy by eliminating manual entry errors and automating order validation. |

| Productivity: |

Enables teams to handle 3? more purchase orders without additional staffing by streamlining workflow execution. |

Industry & Function

| Function: |

Supports Procurement, Finance, and Supply Chain functions through automated data exchange and approval workflows. |

|---|---|

| System Type: |

ERP |

| Industry: |

Retail |

Functional Details

| Scheduling: |

Event-triggered or scheduled hourly sync based on business volume and operational SLAs. |

|---|---|

| KPI Improved: |

95% accuracy, 70% faster processing, improved cash flow visibility. |

Functional Details

| Use Case Type: |

Automates PO creation and updates from procurement systems to Workday Financials reducing manual effort and improving accuracy. |

|---|---|

| Source Object: |

Purchase Orders, Vendor Details, Line Items |

| Target Object: |

Workday Financials Purchase Order and Vendor entities for real-time financial and inventory updates |

| Scheduling: |

Event-triggered or scheduled hourly sync based on business volume and operational SLAs. |

| Primary Users: |

Procurement, Finance, Supply Chain Teams |

| KPI Improved: |

95% accuracy, 70% faster processing, improved cash flow visibility. |

| AI/ML Step: |

Optional AI-based anomaly detection for duplicate POs and predictive insights for supplier reliability. |

| Scalability Tier: |

Enterprise-grade workflow supporting multi-tenant scalability and large transaction volumes. |

Technical Details

| Throughput: |

Processes up to 5,000 PO records per hour. |

|---|---|

| Latency: |

3–5 seconds per transaction. |

Technical Details

| Source Type: |

API-based data ingestion from purchase order systems like Shopify or procurement tools using secure REST endpoints. |

|---|---|

| Source Name: |

Purchase Order Management System or ERP connector initiating order data transfer. |

| API Endpoint URL: |

https://{{workday-tenant}}/ccx/api/v1/{{business-domain}}/purchaseOrders |

| HTTP Method: |

Uses POST for PO creation and PUT for updates to maintain synchronization between systems. |

| Auth Type: |

OAuth 2.0 with token-based secure access. |

| Rate Limit: |

100 requests per minute per client. |

| Pagination: |

Cursor-based pagination for retrieving bulk PO data efficiently from source systems. |

| Schema/Objects: |

PurchaseOrder, LineItems, Vendor, Status. |

| Transformation Ops: |

Field mapping, currency conversion, and schema normalization for Workday Financials |

| Error Handling: |

Retry logic for transient errors, dead-letter queue, and alert notifications. |

| Orchestration Trigger: |

Event-driven automation triggered by PO creation or approval events in the source system. |

| Batch Size: |

Handles up to 500 records per batch to balance throughput and API stability. |

| Parallelism: |

Supports up to 5 parallel threads for faster synchronization and reduced latency. |

| Target Type: |

REST API integration into Workday Financials for real-time PO updates. |

| Target Name: |

Workday Financials system as the centralized procurement and financial management destination. |

| Target Method: |

POST method to create new purchase orders; PATCH for partial updates. |

| Ack Handling: |

Workday Financials returns a success code and PO ID for confirmation and reconciliation logging |

| Throughput: |

Processes up to 5,000 PO records per hour. |

| Latency: |

3–5 seconds per transaction. |

| Logging/Monitoring: |

Centralized dashboard with structured logs, audit trails, and alert monitoring. |

Connectivity & Deployment

| On-Premise Supported: |

Yes — IPSec tunnel for secure internal data transfer |

|---|---|

| Supported Protocols: |

REST, HTTPS, SOAP, SFTP. |

| Cloud Support: |

Compatible with AWS, Azure, Google Cloud, and hybrid environments |

| Security & Compliance: |

SOC 2, ISO 27001, and GDPR compliant for secure data handling. |

FAQ

1. What is the goal of PO to ERP integration?

The primary goal is to eliminate manual data entry by automatically extracting data from incoming Purchase Orders (POs) and creating the corresponding official PO record inside the ERP system (e.g., Acumatica, Oracle Fusion). This streamlines the Procure-to-Pay cycle.

2. How does the system handle unstructured POs (PDFs, images)?

AI Document Understanding technology is used to read unstructured documents like PDFs, scanned images, and emails. The AI intelligently extracts key data fields—such as PO number, vendor details, line items, quantities, and prices—and converts them into structured data the ERP can accept.

3. Can I use Google Sheets to submit a Purchase Order to the ERP?

Yes. While many POs come from vendors, an internal process can use a Google Sheet template for requisition/order entry. The integration tool (e.g., eZintegrations) monitors the Sheet, validates the data, and automatically triggers the creation of a Purchase Order record in the ERP when a new row is added.

4. What happens if the extracted PO data is inaccurate?

The workflow includes validation checks. If the AI detects low confidence in a field or if the data (like a vendor ID or item SKU) doesn't match the ERP's master data, the transaction is flagged. It is routed to a human for review and correction before it is allowed to create the final record in the ERP.

5. Does this integration support custom PO approval workflows?

Yes. The integration is typically configured to respect the existing approval hierarchy in the ERP (Acumatica, Oracle). It can automatically route the newly created or draft PO for the correct internal approvals based on factors like the PO amount, department, or item class.

6. What is the main business benefit of PO Automation?

The main benefit is a significant reduction in processing time and manual errors. Automating PO creation speeds up the entire procurement process, improves data accuracy for inventory and financial reconciliation, and ensures a clean audit trail.

Resources

Resources

Case Study

| Problem: |

Manual purchase order entry caused delays, errors, and poor visibility into procurement and finance workflows. |

|---|---|

| Solution: |

Automated real-time synchronization of purchase orders from external procurement systems to Workday Financials |

| ROI: |

4 FTEs redeployed; 3?month payback |

| Industry: |

Retail |

| Outcome: |

90% faster; 100% accuracy |

Case Study

| Customer Name: |

Global Retailer |

|---|---|

| Problem: |

Manual purchase order entry caused delays, errors, and poor visibility into procurement and finance workflows. |

| Solution: |

Automated real-time synchronization of purchase orders from external procurement systems to Workday Financials |

| ROI: |

4 FTEs redeployed; 3?month payback |

| Industry: |

Retail |

| Outcome: |

90% faster; 100% accuracy |