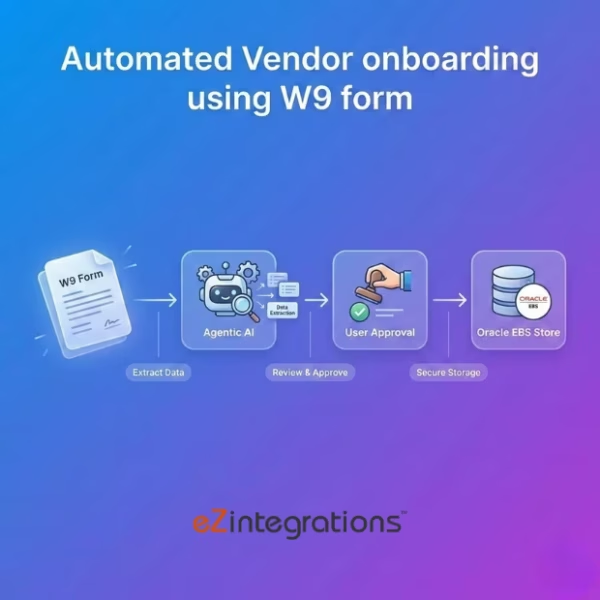

Vendor Onboarding Agent

$0.00

| System Name: |

Onboarding Vendor from W9 forms to Oracle EBS |

|---|---|

| Architecture: |

Hierarchical agent system |

| Coordinator Agent: |

Document Orchestrator |

| Worker Agents: |

OCR Extractor; Validator; EBS Loader |

| Safety Layer: |

Human approval + confidence checks |

Table of Contents

Description

| Planning: |

Schema-driven extraction |

|---|---|

| Messaging: |

Event-based workflow |

| Reflection: |

Low-confidence retry logic |

| Knowledge: |

Vendor onboarding memory |

| Execution: |

Parallel field extraction |

| Business Impact: |

80% faster vendor onboarding |

W9 Processing Agent

The W-9 Processing Agent is designed to automate the end-to-end handling of W-9 documents using a hierarchical agent architecture. A coordinator agent orchestrates the workflow while specialized worker agents handle extraction, validation, and system loading.

Automated W-9 Document Handling with Built-In Controls

The Document Orchestrator coordinates OCR-based data extraction, validates tax information, and loads approved records into Oracle EBS. A safety layer with confidence checks and human approval ensures accuracy, compliance, and secure processing for finance and compliance teams.

Watch Demo

| Video Title: |

Goldfinch Conversational AI | Demo for Demand & Supply Planning |

|---|---|

| Duration: |

2:02 |

Outcome & Benefits

| Autonomy: |

Human-in-the-loop |

|---|---|

| Time Saved: |

Days to minutes |

| Cost Reduction: |

-$35k/year AP ops |

| Reliability: |

Retry + fallback |

Technical Details

| Planner Type: |

AI + Rules Engine |

|---|---|

| Agent Roles: |

Coordinator + Specialists |

| Scheduling: |

Event-driven |

| Tool Router: |

Confidence-based routing |

| Evaluation Metrics: |

Field accuracy % |

| Auditability: |

Full document traceability |

FAQ

1. What is the W9 Processing Agent system?

It is a hierarchical agent-based system designed to automate the processing of W-9 tax forms by extracting, validating, and securely loading data into downstream systems with human oversight.

2. How does the W9 Processing Agent work?

The system uses a Document Orchestrator to coordinate OCR extraction, data validation, and loading into EBS systems, ensuring accurate and compliant W-9 processing.

3. What roles do the worker agents perform?

The OCR Extractor reads and digitizes W-9 documents, the Validator checks data accuracy and completeness, and the EBS Loader securely loads approved data into enterprise back-end systems.

4. How is data accuracy ensured?

Accuracy is ensured through automated validation rules, confidence scoring, and mandatory human approval for low-confidence or exception cases.

5. What types of W-9 data are processed?

The system processes taxpayer name, business details, tax classification, TIN/SSN, signatures, and other required W-9 fields.

6. Who typically uses this system?

Finance operations teams, tax compliance teams, and vendor management teams use the W9 Processing Agent to streamline tax form handling.

7. How does the safety layer work?

The safety layer enforces human approvals and confidence checks to prevent incorrect or non-compliant data from being processed automatically.

8. What are the key benefits of the W9 Processing Agent?

It reduces manual data entry, improves processing accuracy, ensures compliance, and accelerates W-9 onboarding and validation workflows.

Resources

Case Study

| Industry: |

Finance/Procurement |

|---|---|

| Problem: |

Manual W-9 processing |

| Solution: |

Automated intelligent intake |

| Outcome: |

Faster compliant onboarding |

| ROI: |

6 months payback |