How to Extract Mortgage Document Data and Send It to Any Target

$0.00

| Workflow Name: |

Extract Mortgage Document and Send It to Any Target |

|---|---|

| AI Model Type: |

LLM / Vision |

| Model Provider: |

Goldfinch AI / OpenAI |

| Task Type: |

Mortgage Data Extraction |

| Input Type: |

PDF / Image |

| Output Format: |

JSON / CSV |

| Who Uses It: |

Banks; Loan Ops Teams |

Table of Contents

Description

| Problem Before: |

Manual mortgage review |

|---|---|

| AI Solution: |

OCR + clause extraction |

| Validation (HITL): |

Risk-based review |

| Accuracy Metric: |

Clause accuracy % |

| Time Savings: |

70% faster review |

| Cost Impact: |

Lower underwriting cost |

Extract Mortgage Document and Send It to Any Target

This workflow enables Mortgage Document Extraction from PDFs and images using LLM and vision models.

Automated Mortgage Data Processing

The system identifies and structures key mortgage details such as borrower information, loan amounts, and terms, then delivers the output in JSON or CSV format to any target system. It helps banks and loan operations teams reduce manual effort, improve accuracy, and accelerate mortgage processing workflows.

Watch Demo

| Video Title: |

How AI can Solve Challenges & Problems of Unstructured Documents? |

|---|---|

| Duration: |

9:13 |

Outcome & Benefits

| Accuracy: |

95% |

|---|---|

| Touchless Rate: |

65% |

| Time Saved: |

From 30m to 8m/doc |

| Cost Saved: |

$4.00 per doc |

Functional Details

| Business Tasks: |

Mortgage processing |

|---|---|

| KPI Improved: |

Approval cycle time |

| Scheduling: |

Batch / On-demand |

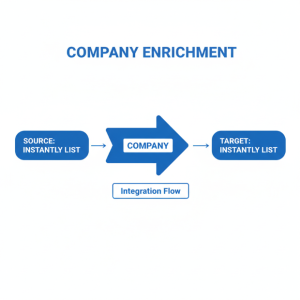

| Downstream Use: |

Datalake / Loan Systems |

Technical Details

| Model Name/Version: |

GPT-4o-mini |

|---|---|

| Hosting Type: |

Secure Cloud API |

| Prompt Strategy: |

Clause-aware prompts |

| Guardrails: |

Financial compliance checks |

| Throughput: |

40 docs/min |

| Latency: |

~4s/doc |

| Data Governance: |

Financial data controls |

FAQ

1. What is the Extract Mortgage Document and Send It to Any Target workflow?

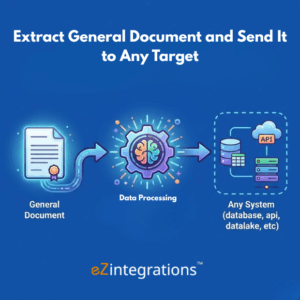

It is an AI-powered workflow that uses LLM and vision models to extract structured mortgage data from documents and send it to any target system.

2. How does the workflow work?

The workflow ingests mortgage documents in PDF or image format, applies LLM and vision models to extract key mortgage fields, and exports the structured data in JSON or CSV format to the configured target.

3. What information can be extracted from mortgage documents?

It can extract details such as borrower name, loan number, property address, loan amount, interest rate, payment schedule, lender information, and other mortgage-specific metadata.

4. How is sensitive mortgage data handled?

The workflow enforces data security and privacy measures including access controls, encryption, and compliance with financial regulations to protect sensitive borrower information.

5. What is the output of the workflow?

The extracted mortgage data is output in JSON or CSV format and can be sent to banking systems, loan processing platforms, Datalakes, or analytics tools.

6. Who uses this workflow?

Banks and Loan Operations Teams use this workflow to automate mortgage document processing, reduce manual entry, and improve data accuracy.

7. What are the benefits of automating mortgage document extraction?

Automation improves processing speed, ensures accurate data capture, reduces errors, and enables seamless integration with downstream banking and loan management systems.

Resources

Case Study

| Industry: |

Banking / Finance |

|---|---|

| Problem: |

Slow loan approvals |

| Solution: |

AI mortgage extraction |

| Outcome: |

Faster loan decisions |

| ROI: |

4-month payback |