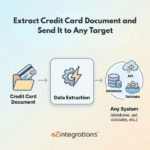

How to Extract Credit Card Documents and Send Data to Any Target

$0.00

| Workflow Name: |

Extract Credit Card Document and Send It to Any Target |

|---|---|

| AI Model Type: |

Vision / LLM |

| Model Provider: |

Goldfinch AI / OpenAI |

| Task Type: |

Secure Data Extraction |

| Input Type: |

PDF / Image |

| Output Format: |

JSON / CSV |

| Who Uses It: |

Finance Ops; Compliance Teams |

Table of Contents

Description

| Problem Before: |

Manual handling of card documents |

|---|---|

| AI Solution: |

OCR + tokenized card data extraction |

| Validation (HITL): |

Masked QA review |

| Accuracy Metric: |

Field-level accuracy % |

| Time Savings: |

85% faster processing |

| Cost Impact: |

Lower compliance effort |

Extract Credit Card Document and Send It to Any Target

This workflow enables Credit Card Extraction using vision and LLM models to securely process credit card documents from PDFs or images.

Secure Financial Data Processing

The system identifies and structures sensitive card-related information, applies validation and security controls, and exports the results in JSON or CSV to any target system. It supports finance operations and compliance teams by reducing manual handling, improving accuracy, and ensuring secure document processing

Watch Demo

| Video Title: |

AI Document Understanding – Data Flow & Use Cases |

|---|---|

| Duration: |

12:24 |

Outcome & Benefits

| Accuracy: |

97% |

|---|---|

| Touchless Rate: |

80% |

| Time Saved: |

From 6m to 1m/doc |

| Cost Saved: |

$0.50 per doc |

Functional Details

| Business Tasks: |

Card metadata extraction |

|---|---|

| KPI Improved: |

Security; processing time |

| Scheduling: |

Batch / Real-time |

| Downstream Use: |

Datalake / Risk Systems |

Technical Details

| Model Name/Version: |

GPT-4o-mini Vision |

|---|---|

| Hosting Type: |

Secure API / Cloud |

| Prompt Strategy: |

Schema + masking rules |

| Guardrails: |

PCI masking; redaction |

| Throughput: |

80 docs/min |

| Latency: |

~2s/doc |

| Data Governance: |

No storage of raw PAN |

FAQ

1. What is the Extract Credit Card Document and Send It to Any Target workflow?

It is an AI-powered workflow that securely extracts structured data from credit card documents using vision and LLM models and sends the output to any target system.

2. How does the workflow work?

The workflow ingests credit card documents in PDF or image format, applies vision and LLM models to extract relevant fields, enforces security rules, and exports the data in JSON or CSV format to the configured target.

3. What type of information can be extracted?

It can extract details such as cardholder name, masked card number, issuer, expiration date, billing address, and other permitted metadata based on security policies.

4. How is sensitive data protected?

The workflow applies secure data handling practices such as masking, encryption, and access controls to ensure compliance with PCI and internal security requirements.

5. What is the output of the workflow?

The securely extracted data is output in JSON or CSV format and can be sent to finance systems, compliance platforms, Datalake, or other approved targets.

6. Who uses this workflow?

Finance Operations Teams and Compliance Teams use this workflow to automate document processing while maintaining strict data security and regulatory compliance.

7. What are the benefits of automating credit card document extraction?

Automation reduces manual handling of sensitive data, improves accuracy, enhances security controls, and supports faster, compliant financial operations.

Resources

Case Study

| Industry: |

Banking / FinTech |

|---|---|

| Problem: |

Sensitive document handling |

| Solution: |

Secure AI extraction |

| Outcome: |

Faster and compliant processing |

| ROI: |

2-month payback |